Risk Transfer and Reinsurance Optimization

Complex risk and contract structures along with fierce competition in the reinsurance procurement market are significant factors influencing the business outcomes of any life, health, or non-life insurer. The compilation and parameterization of a suitable reinsurance portfolio present high-dimensional mathematical problems, whose solutions depend on a wide range of factors.

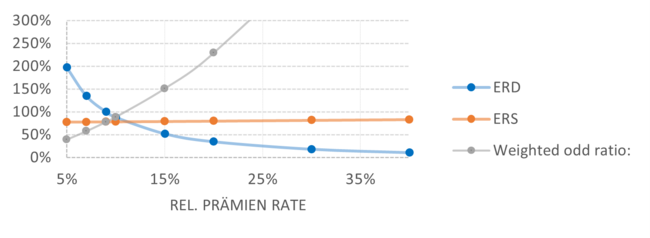

Testing Sufficient Risk Transfer

Test the risk transfer of individual reinsurance contracts in each category or of your entire reinsurance program for regulatory or economic purposes, using common metrics such as ERD, RCR, or weighted odd ratios.

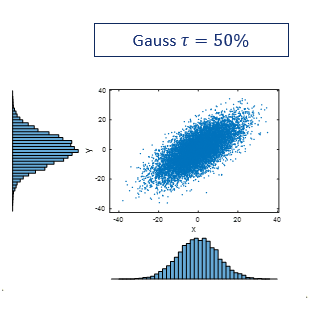

Adjustment of Stochastic Models

All of your reinsurance-relevant segments will be analyzed, with stochastic models being adjusted, simulated, and validated.

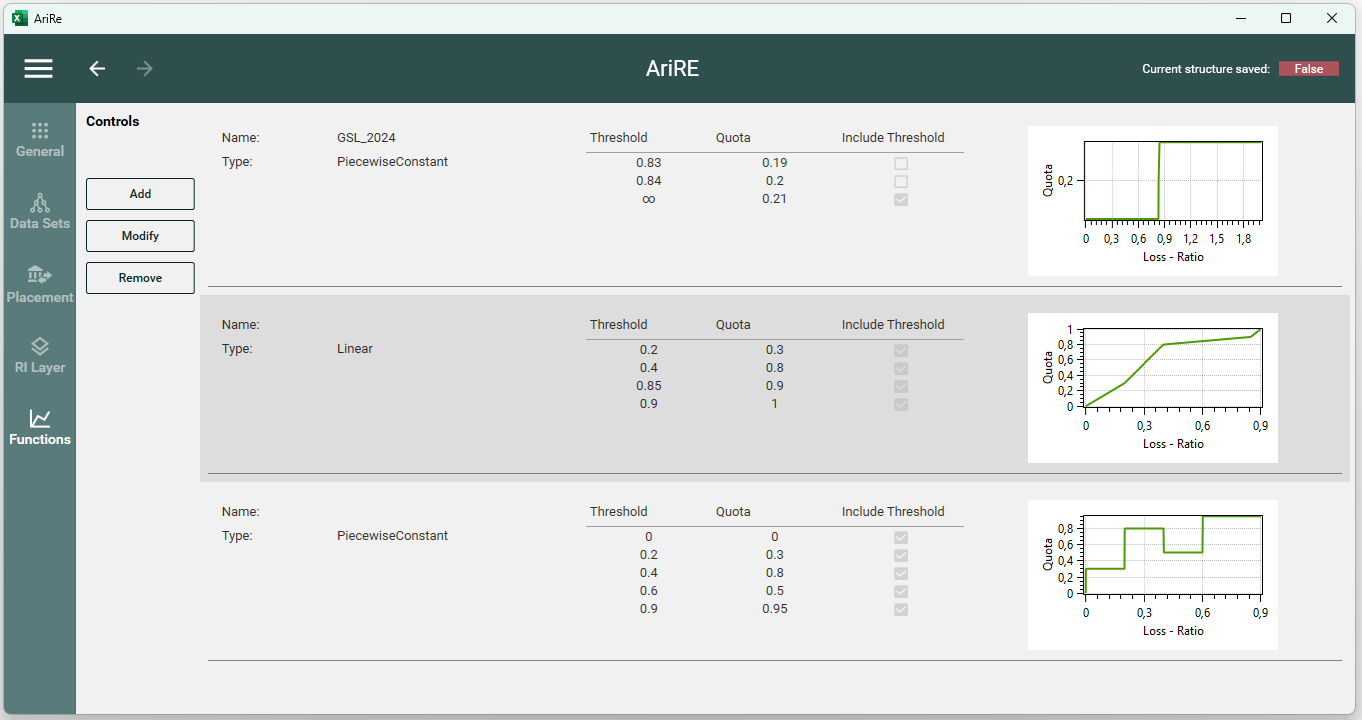

Monte Carlo for the complex reinsurance program with ari|RE

Simulation of Reinsurance Contracts and Correlations

All reinsurance contracts across different lines of business, including their correlations, can be simulated using the Monte Carlo method.

Backtesting of Profit and Loss Statement

How would the EGT of the past five years have developed if a specific layer had not been reinsured?

What if certain parameters had been set differently?

What changes would occur in the budget for the next three years if a new stop-loss layer were added?

Optimal Pricing

We provide you with the best possible preparation for your annual reinsurance renewal! What is the optimal value of individual parameters to ensure a fair and appropriate price?