Solvency II requires modern risk management including all aspects of strategy, processes and reporting of risk, which originate from the daily business activity, or have a chance to arise from it. The risk manager is responsible for the identification, evaluation, monitoring, management, prioritization and reporting of business risks in your undertaking.

We gladly support you in this endeavour!

Actuarial and Risk Management Funktion

Support and Outsourcing

If you have resource bottlenecks to fulfil the legal Solvency II requirements in the Actuarial or Risk Management department, which are very demanding in terms of time, due to external circumstances, our experienced team is ready to assist you. We can support you at short notice or take over your activities in full for a limited period of time. Long-term outsourcing approved by supervisors is also part of our portfolio with long-standing experience in the Non-life insurance business.

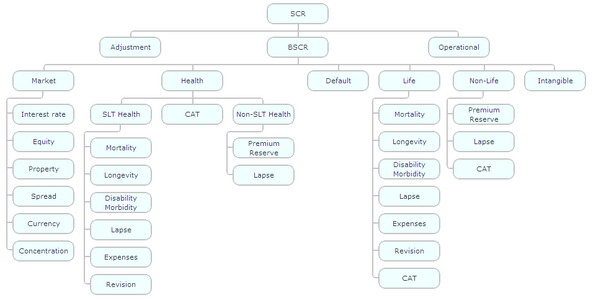

Standard Formula support

We support you in the calculations of the Solvency Capital Requirement according to the Standard Formula. From experience standard does not stand for simple - we help in the implementation and interpretation of your model, based on the level 1 (directive), level 2 (delegated regulation), level 3 (EIOPA guidelines) and level 4 (local regulations).

Solvency II is often treated as a cost factor only, we will support you to give this process a meaning and how to use the Solvency II key figures for business controlling.

Within the next year EIOPA will publish their recommendations of changes to the Standard Formula. We are watching this process and suggest performin impact studies already on the existing drafts.

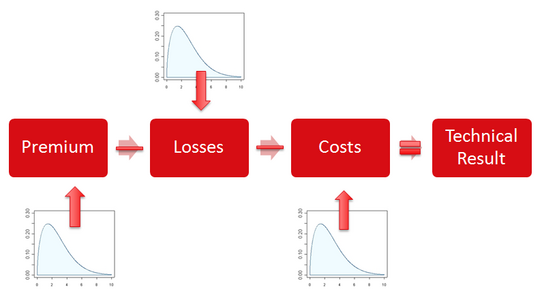

USP - Undertaking Specific Parameter

Some of the parameters of the standard formula can be adapted to your own company, namely the so-called undertaking specific parameters (USP). This calculation is intended to adequately reflect the underlying risks and may have a significant impact on the solvency capital requirement. Even if you do not intend to apply for this from the supervisory authority, at least the risk management department should have a rough assessment of the company's internal risk parameters. From a purely legal point of view, supervisors can order the application of the USPs if it is assumed that there are significant deviations from the underlying assumptions of the standard formula. Results of a USP calculation can be reused in a variety of reports.

We have already provided actuarial support to an Austrian insurance company from a USP preliminary study to approval by the FMA, and have thus set a quality standard for Austria from which you can also benefit.

Key benefits:

- Risk-adequate calculation of your premium- and reserve risk

- Includes a Review of actual Best Estimate calculations

- Profit from our experience with supervisors regarding internal models and USP

Internal Model

If the nature, scale and complexity of the risks inherent in the activities of an undertaking are not covered by the Standard Formula, an (re)insurance undertaking can apply or be motivated by the supervisory authority to develop a (partial) internal model.

Internal models have to be authorised by the local supervisory authority, and besides a complex mathematical development and implementation an extensive governance requirements must be fulfilled.

With our internal risk model ariSE we already accompanied the Vienna Insurance Group from the underlying idea until the authorization by the supervisory authority. The usage of an internal model does not just inform you about the risks, but the chances as well. Management boards can use new risk key figures for several purposes like reinsurance optimisation, pricing and business planning.

We advise and assist you with our experience if you plan to perform your business valuation and corporate governance under Solvency II using the internal model. Both in the development and implementation of the model, as well as in the entire regulatory approval process our experienced actuaries will be happy to assist you.